You know how to save. You were probably taught from a very early age to do it. You may have had a piggy bank as a kid. Your parents may have opened a bank or credit savings account for you when you got your first job as a teenager. They probably encouraged you to put some of your paper delivery, berry picking or babysitting money in that account. When you got your first real job as a young adult, your boss or mentor may have nudged you to fund a (employer-sponsored) retirement account. So, you have been saving your entire life and you were good at it. You are now able to retire. But what happens when you transition from saving to withdrawing? No one probably taught you how to do that properly. So, read on for some valuable guidance about tax-efficient retirement withdrawal strategies.

Savings Vehicles

Let’s first start with a review of the different vehicles in which you can save for retirement. They have unique tax characteristics and you need to understand them before you start taking distributions from them. Traditional retirement accounts like 401(k)s, 403(b)s, IRAs, profit sharing plans, and deferred compensation plans allow you to defer income without paying tax on the amounts deferred. Further, the amounts inside these accounts grow tax-free over time. However, when you begin taking withdrawals from any of these accounts, you are subject to ordinary income tax.

You can also save in a Roth IRA. But the Roth is different, because contributions to it are made after taxes have been paid, not before. However, the amounts inside your Roth IRA still grow tax-free and when you take withdrawals from your Roth IRA, they will be tax-free. The Roth IRA is also appealing, because you are not required to take distributions from it when you reach age 72 (new age under the recently-passed SECURE Act), as you are with other traditional retirement accounts (e.g. an IRA).

If you have put as much into conventional retirement accounts as permitted by law, you can also save in a savings account, CDs or investment brokerage account. There are, however, no tax benefits to this form of savings. The money you save in these vehicles goes in after you have paid taxes. The income and gains you receive in these accounts are taxed as ordinary income and capital gains, respectively.

Sources of Income

As you contemplate your need for income in retirement, you will probably have a variety of sources. You will very likely have Social Security benefits. You may also work part time. You might have income from rental property. But these sources may not provide enough income to meet your needs. So, you can supplement your income with tax efficient withdrawals from your various savings vehicles.

Let’s say, for example, that you need $100,000 per year in income in retirement. We will assume Social Security will provide you with $35,000. You are not working part time and you do not own rental property. So, you need to withdraw $65,000 from your other savings vehicles. Let’s assume that you have $1 million in an IRA, $500,000 in a Roth IRA and $500,000 in an investment brokerage account. What is a tax-efficient retirement withdrawal strategy?

Don’t leave your future to chance. Contact our team at Springwater Wealth today to learn how we can help you develop a financial plan for your peace of mind.

Withdrawal Strategies

Conventional Approach

The conventional approach to taking distributions from retirement accounts is designed to avoid paying taxes, defer taxes and minimize taxes for as long as possible. How? Typically, you would start in retirement by first taking money from the brokerage account. If you take cash out of that account, it is not taxable. Dividends and interest in the brokerage account are subject to income taxation. Gains that are realized in a brokerage account are subject to capital gains taxes. But the capital gains tax rate is generally less than ordinary income tax rate. By spending down the brokerage account, you are deferring income taxation of your IRA. Some people then begin taking distributions from the IRA. These withdrawals are taxable, as noted above. However, distributions are required by age 72 and some people begin taking them early in retirement (after spending down the brokerage account) to reduce the amount of required distributions in the future. Once the IRA is exhausted, the conventional approach would have you take future distributions from the Roth IRA.

Another approach to this conventional withdrawal strategy would be to take distributions from the Roth IRA (instead of the IRA) after exhausting the brokerage account. However, while there would be no taxes on the withdrawals from the Roth IRA, you are setting yourself up for larger distributions from your IRA when you are forced to take them beginning at age 72.

Proportional Approach

The proportional approach to taking distributions from retirement account is very simple. You would take the amount needed from each of the accounts in proportion to values in the accounts. So, here is the basic math. You have $2 million in savings accounts. The brokerage account ($1 million) is 50% of the total. The IRA ($500,000) is 25%. The Roth IRA (also $500,000) is 25%. As we stated, you need $65,000. We need to make some assumptions about taxes. Let’s assume that this year, you can take funds from your brokerage account and pay no taxes, your combined tax rate on distributions from your IRA is 25% and that you pay no taxes on withdrawals from your Roth IRA. Therefore, under the proportional approach, you would take 25% of the $65,000 or $16,250 from the brokerage account (tax free in this example). You would take $43,333 (50% of $65,000 X 1.33 to gross up for taxes) from the IRA, pay taxes of $10,833 and net $32,500. You would take 25% from the Roth IRA and receive $25,000 tax-free. So, your distribution total is $65,000 or ($16,250 + $32,500 + $16,250). The proportional approach will provide greater total dollars to you than the conventional approach. But it is simplistic and will still result in you paying more taxes than is necessary.

The best tax-efficient retirement withdrawal strategy is a dynamic approach. Warning: This approach is not simple and is not necessarily easy. In fact, you may find this approach a bit overwhelming. But it is, by far, the best approach and you should consider using it throughout your retirement.

Dynamic Approach

The dynamic withdrawal strategy involves assessing your overall financial situation annually and making decisions related to your need for income based on a variety of factors. You would do this in the fall for the upcoming. However, you will be looking forward beyond the next year, because there may be planning opportunities that will play out over several years. The objective of the dynamic approach is to minimize the total amount of taxes you pay not just in a given year, but over your entire retirement.

Let’s continue to assume that you need $65,000 in addition to the $35,000 you expect to receive in Social Security benefits. Let’s also assume that tax rates and the general provisions of the tax code remain the same throughout your retirement. This is admittedly not realistic. But, because we do not know what the changes will be, we cannot plan for them. We will accept inflation as a given which means that your income need will increase every year by the then-current rate of inflation.

If you have not yet reached age 72, you are not required to take a distribution from your IRA. However, it may well be wise to do so. Why? Because, if your objective is to meet your annual income needs and pay as little tax (in total over your retirement), it may well make sense to take distributions before they are required, because they will be taxed at rates that are lower than would be in effect if you were to wait and be forced to take larger distributions.

Our tax system is progressive. So, as your income goes up, the rate of taxation goes up. You will want to carefully consider the rate of taxation associated with the distributions you take in every year of retirement. The general idea is to “fill up” the tax brackets with lower rates and avoid those with higher rates. Also, note that the capital gains rate is lower than the income tax rate. You will want to take advantage of the lower capital gains rates when appropriate.

The Roth Conversion

If you are over the age of 59 ½, but not yet 72, you may want to take withdrawals from your IRA, pay taxes on them and convert them into your IRA. Why would you do this? By moving money from your IRA to your Roth IRA, you may be able to reduce your overall tax burden. Remember, dollars in a Roth IRA grow tax free, come out tax free and are not subject to minimum distribution rules.

Capturing Tax Losses

Another opportunity involves planning distributions around significant tax-related events. For example, if you plan to make a large tax-deductible charitable donation, you may wish to take a withdrawal from your IRA that is larger than your actual needs for that year. You could use the tax deduction from the gift to reduce your taxes in that year. What if you are expecting to have major surgery for which very substantial out-of-pocket costs will be tax-deductible? Or imagine being in a care facility later in life and paying many thousands of dollars each month for your care. These circumstances may present opportunities to take a large distribution from your IRA. You can use the medical cost deduction to offset your income from your IRA. What about a large loss embedded in one of the positions in your brokerage account? You might sell that position, realize the loss and simultaneously sell another position in that account with a large embedded gain. The losses and gains will offset and you will have freed up dollars without incurring taxes.

Managing Medicare

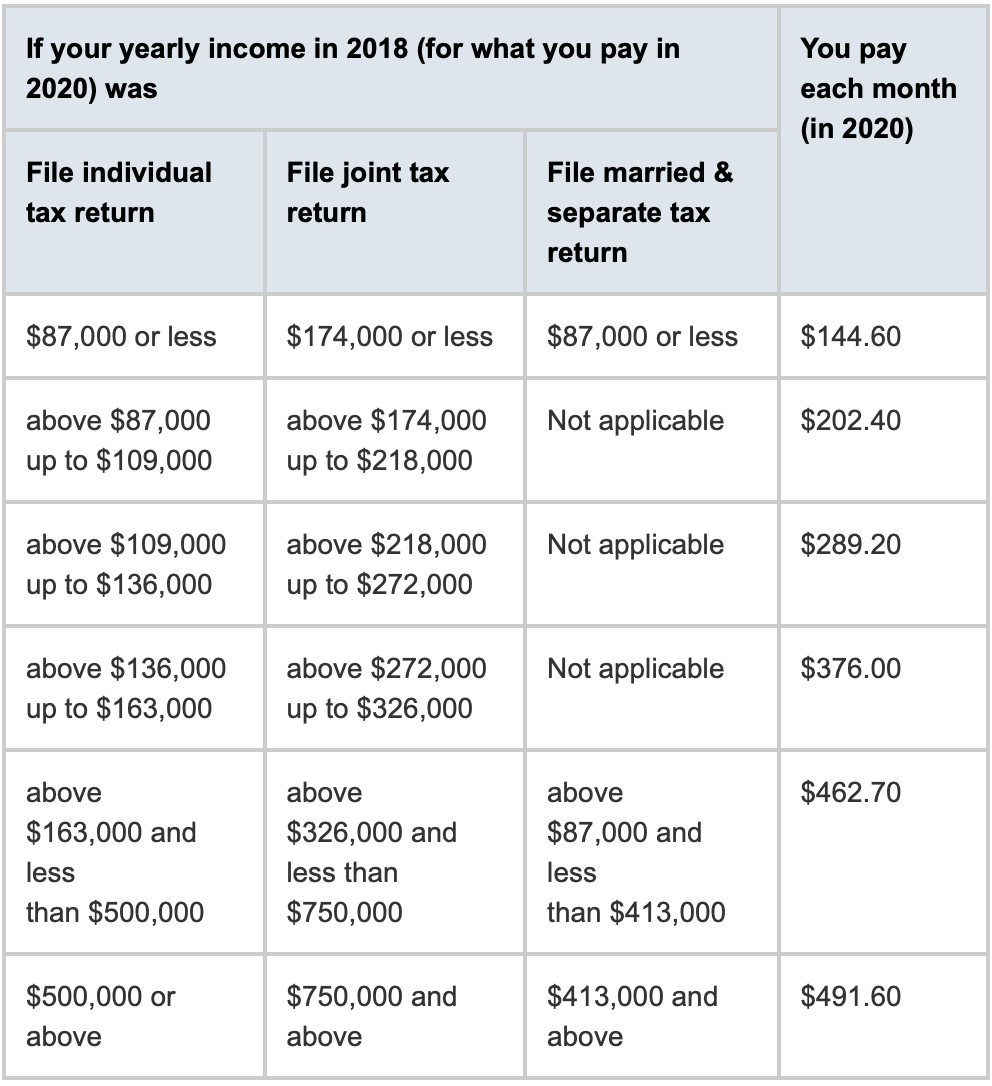

You may know that the premium you pay for Medicare (Part B) is directly related to your income. Here’s the table provided by Medicare.

As you can see the higher your income, the higher your Medicare premiums. So, another aspect of the dynamic withdrawal strategy is manipulating your income to minimize your Medicare Part B premiums.

If this is beginning to seem a bit complex, you should consider hiring both a financial planner and a tax professional to assist you. These advisors will have knowledge, experience and (software) tools that they can use to assist you. Yes, you will pay for these services. But it is highly likely that the taxes that you save will be far greater than the costs you incur for professional advice.

While there are simpler ways to withdraw funds from your retirement savings accounts, the dynamic approach is the most tax-efficient withdrawal strategy.

PLEASE SEE important disclosure information at www.springwaterwealth.com/blog-disclosure/.