The statistics from the U.S. Department of Health and Humans Service will get your attention. Nearly 7 out of 10 Americans will use long-term care services at some point in their lives. The average period of care is three years. Women need care for an average of 3.7 years. Men need care for an average of 2.2 years.

Before we get too far into this topic, we should define what we mean be “long-term care.” People need this care when then they can no longer able perform the “activities of daily living” (ADLs). These activities are generally defined as bathing, dressing, eating, continence, mobility and transfers.

Insurance coverage for care usually requires a person to be unable to perform two or more of these six ADLs.

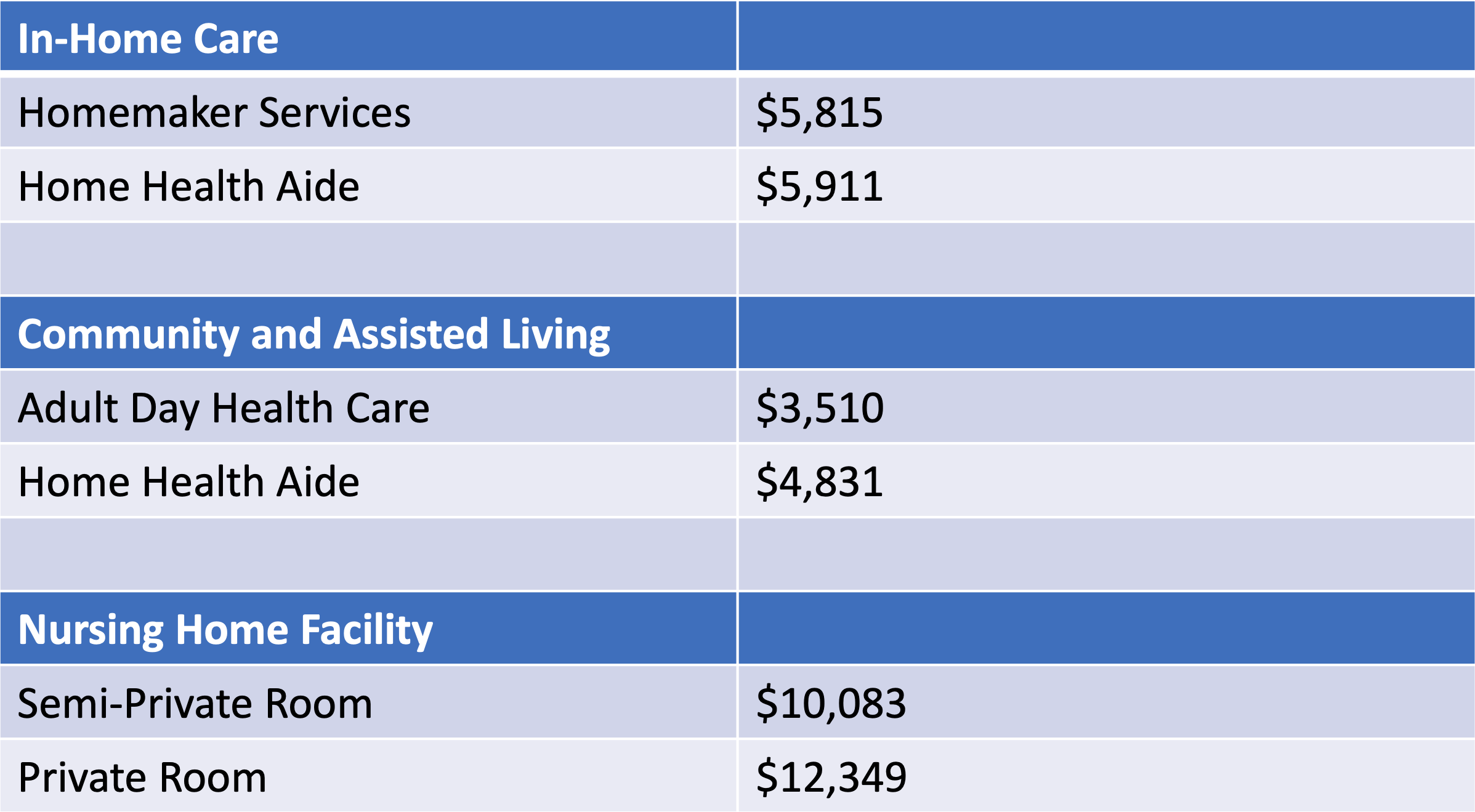

What does care cost? In Portland, Oregon, in 2020, Genworth reports that the monthly median costs of care were:

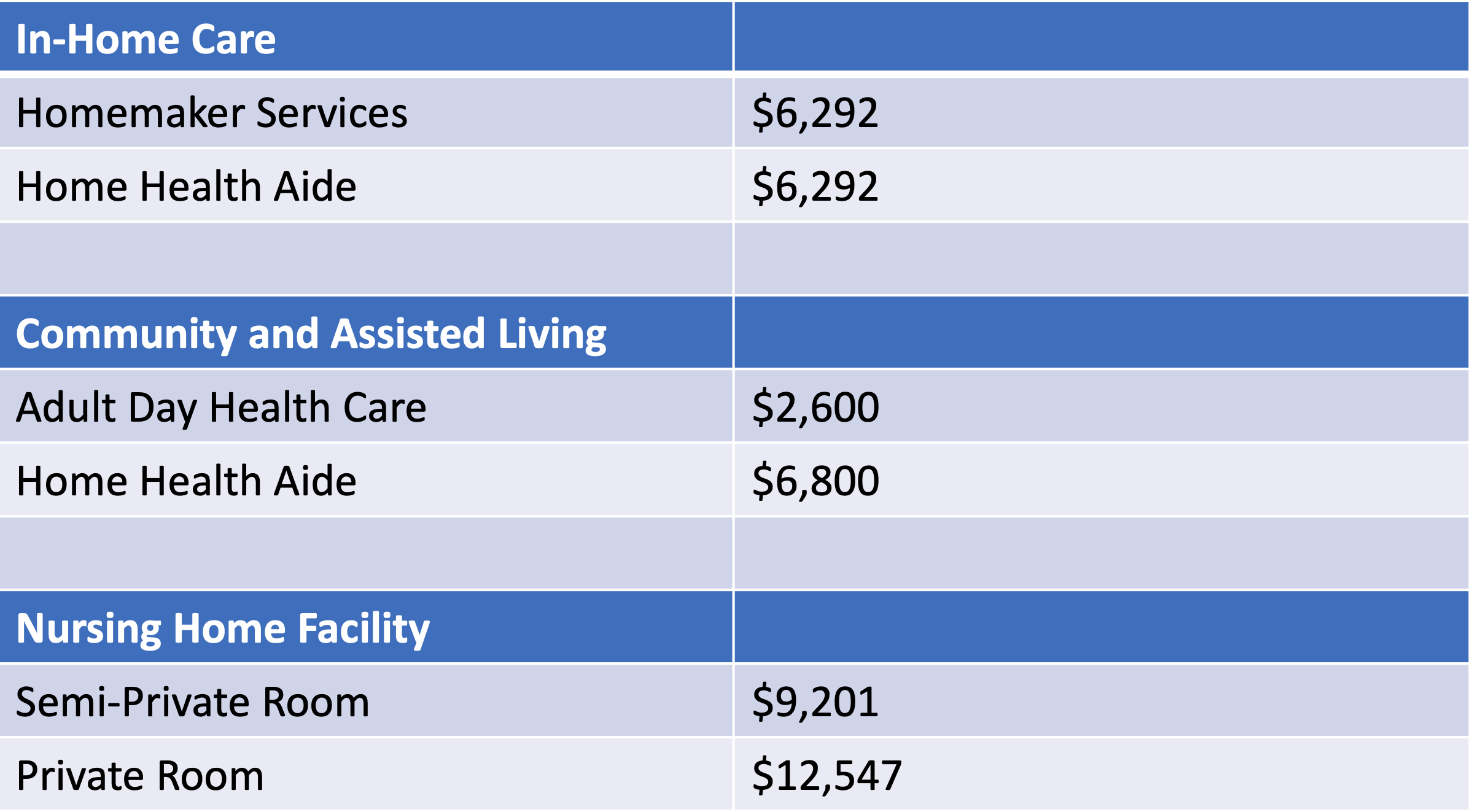

In Santa Cruz, California, in 2020, Genworth reports the monthly median costs of care:

Now that we have your attention, let’s identify the issues you should consider as you think about this topic. The question we’re trying to answer is, “Should I buy long term care insurance?” We’ll find that this topic is complex and for many people the answer isn’t obvious.

Family Health History

Perhaps the place to start is with your family. Did your grandparents, parents, or aunts and uncles need care? If so, why did they need care? How long did the care last? Who provided the care?

Did the generations before you have conditions that are sometimes passed down through families? For example, Alzheimer’s disease, Parkinson’s disease, dementia, cancer, arthritis, or high blood pressure?

What kind of lives did these family members live? Did they eat well? Did they exercise? Did they smoke, drink, or have other unhealthy habits? Did they visit the doctor for annual exams, and practice preventative health care? If they needed care, can you conclude that their lifestyles led to their need for it?

Personal Health Profile

Now consider yourself. If you’re female, statistically you’re more likely to need care. If you’re single, you’re more likely to need care than someone who’s married. The older you are, the more likely you’ll need care.

Do you eat well? Is your diet balanced properly? How much alcohol do you drink? Do you smoke? Do you use recreational drugs? Do you exercise regularly? Do you visit your personal doctor for an annual exam and follow her recommendations for healthy life? Do you practice a religion? Do you meditate?

Health care professionals tell us that the likelihood of needing care is closely related to how well we take care of ourselves. So, if you want to avoid ever needing care, you should make a lifelong commitment to living a healthy life.

Sources of Support

If you do need care at some point, who will provide it? Will your spouse or partner be able to help you? How old is your spouse? How capable of caring for you are they? What kind of care might you need, and for how long? What about children? If you have children, would they care for you? Could they? Where do they live? Could they step away from their lives to become your caregiver?

Surveys tell us that most care is provided by family members in the family home. While that may be true, we know that family caregivers take on a great burden. Providing care is physically, emotionally and psychologically draining.

You should think carefully about whether it’s realistic to have a family member provide care for you. Also, if a family member does provide care, your needs may eventually exceed the ability of your family to provide it. Then what?

Financial Considerations

One of the reasons most care is provided by family members is that few families have the funds to pay for outside care. They don’t have savings set aside to pay for care and they don’t own long-term care insurance.

What’s your situation? Do you have money set aside specifically for long-term care later in life? Do you own long-term care insurance? We saw above how expensive care can be. A three-year period of care could easily cost more than $200,000. How would you pay for it?

Most states have agreements with Medicaid to provide long-term care services for those individuals who have extremely limited resources to pay for it. A full discussion of this approach is beyond the scope of this article. But if you have little savings, you should explore how you might qualify for long-term care through your state and Medicaid.

Long-Term Care Insurance

If you think you may need care one day, but you don’t want to set aside several hundred thousand dollars for it, you should consider long-term care insurance. There are several varieties of long-term care insurance. Traditional long-term care insurance provides a daily benefit for a specified period. The benefit is indexed for inflation, so your purchasing power is preserved. An example would be a policy that provides a $200 per day benefit for up to three years, with a waiting period of 90 days before benefits can be paid.

Hybrid long-term care insurance combines life insurance and long-term care insurance. The contract pays for care, if you need it. There is also a death benefit. The less care you need, the greater the death benefit.

Some cash value life insurance policies include a so-called “living benefits” rider that provides a portion of the death benefit if you become terminally ill. You could use these funds to pay for medical expenses, including care.

If you’re someone who generally buys insurance to transfer risk, you should consider some form of long-term care insurance.

Have a Plan

We’ve discussed many factors involved with long-term care. Now you should develop your own plan.

Where will you live as you get older and less physically capable? Do you need to modify your home, so that you can “age in place?”

If you reach a point where you can no longer perform one or more of the ADLs, what will you do? Who will provide the care? How will you pay for it?

The sobering reality is that most of us will need assistance at some point in life. Plan for it. You may never need help. But, if you do, you’ll be ready.

Looking for Guidance?

If you need help thinking about long-term care insurance, consider working with a Certified Financial Planner™ (CFP®). Advisors who hold this designation have met rigorous educational, experience and ethics requirements.

If you’re looking for help with your retirement planning – including exploring long-term care insurance – contact us today to see how our team at Springwater Wealth can help you.